Rocking retirement like Leonard Cohen

The life of Leonard Cohen offers an inspiring example of making a success of your retirement years, despite setbacks and unexpected circumstances. Far from being the self-styled 'grocer of despair', when life gave him lemons, Leonard made lemonade. Read on, and take a leaf out of Leonard's book to rock your later years.

It’s 1994 and Leonard Cohen’s career has been on the up over the last few years, a major turnaround from the desperate days of the late 1980s when his record company nearly dropped him. But Leonard is exhausted from touring and from too much drinking, drugging and womanising. He’s had it; with himself, with the music business, with everything.

Retirement fund

But his efforts of the last few years means he has a tidy retirement sum put away. So he retreats to a Zen Buddhist monastery at the top of Mount Bauldie in California, where he studies under Zen master Roshi, leaving all his financial affairs in the hands of his long-time manager Kelley Lynch, whom he trusted implicitly.

Not much is heard from Leonard until, after five years, he decides he’s had enough of a life of prayer and meditation. That turns out not to be the answer after all. He comes down from the mountain and, to the surprise of many, returns to music, releasing a couple of albums over the following years.

Gone

But in the mid 2,000s he begins to suspect things are not quite as they should be – and discovers that his manager had stolen (and spent) more than $5 million from the fund he had set up for his retirement.

At 71 he found himself back on main street with almost all his money gone. So, instead of quietly retiring, he needs to pick up his career again.

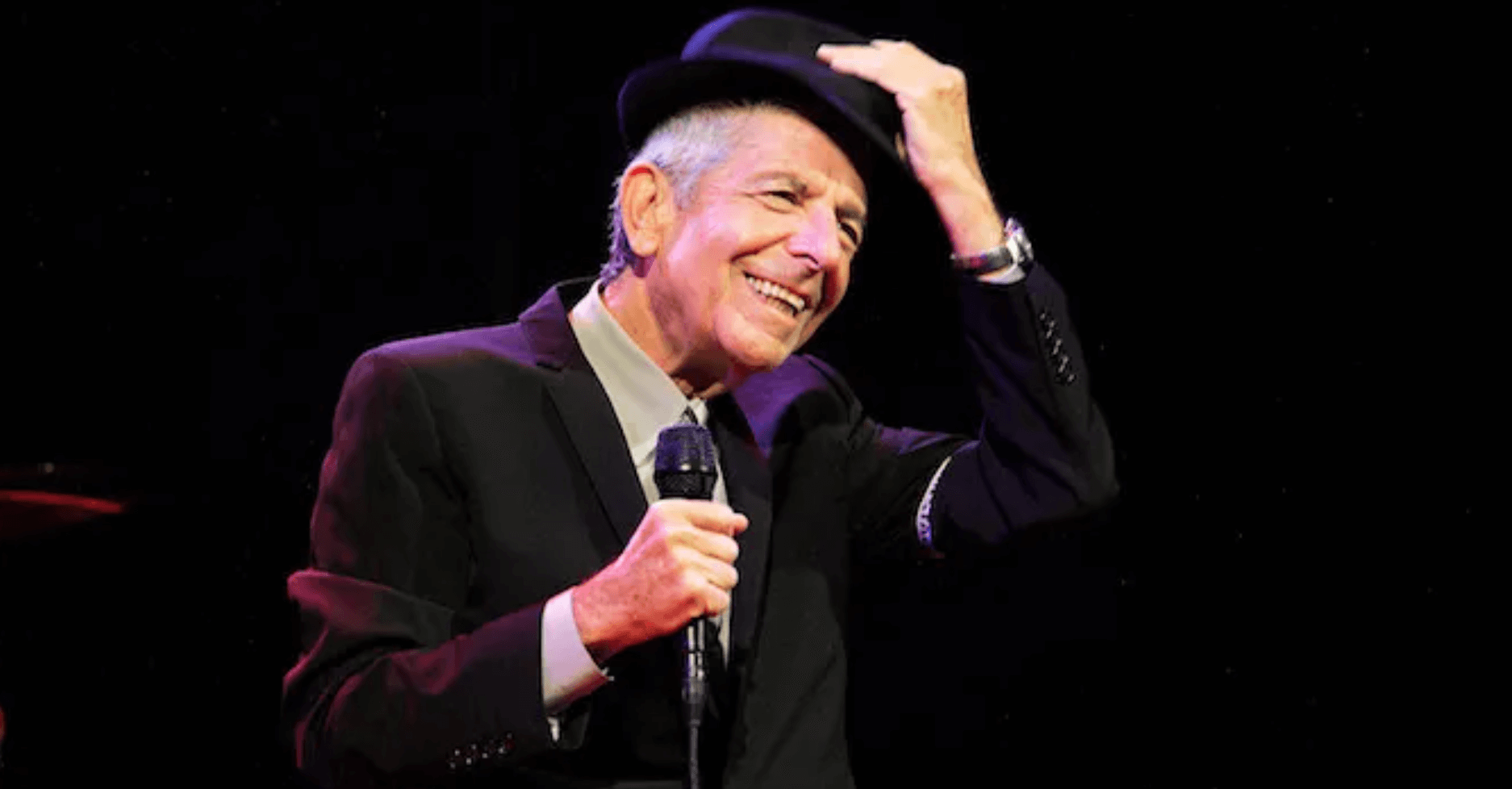

Back on the road

He had always hated touring, but now he assembled a band, rehearsed for three months, and set out on the road.

And to his own surprise, he fell in love with it.

[Above: Cohen at Coachella 2009 in Indio, California. Photo by Wendy Redfern/Redferns]

Over the next five years, selling out bigger and bigger stages, Leonard Cohen’s touring would propel him to heights his career had never previously reached and bring him far more money than he had ever made before.

Furthermore, a cover version of Hallelujah, which when first recorded back in the 1980s the record company had not wanted to release, had been used on the soundtrack for the movie Shrek, and was now a worldwide classic threading its way into every corner of the music and entertainment worlds.

Important to note also that this was no tired rehash of old glories. Bringing together an exceptional band of musicians, he reinvented and reinvigorated his classic songs for a new era.

In the gypsy-inflected recasting, his songs retained their original clarity and sparseness, their taut personal directness, but are now interlaced with the warmth of the Balkans and the Mediterranean, drawing from his earlier formative years on the Greek island of Hydra, and realised with superb musicianship.

Rather than fading quietly to black, necessity, that time-honoured mother of invention, prompted a renewal and resurgence of his creative life – and in turn invigorating fresh connection with existing and new fans across the world.

Rocking retirement like Leonard Cohen

But what lessons are there for the rest of us who don’t have the safety net of a brilliant back catalogue?

Keep an eye on your savings

For one, don’t leave your nest egg totally in others’ hands. Take advice but also, from time to time, check on what’s happening and where your savings are invested.

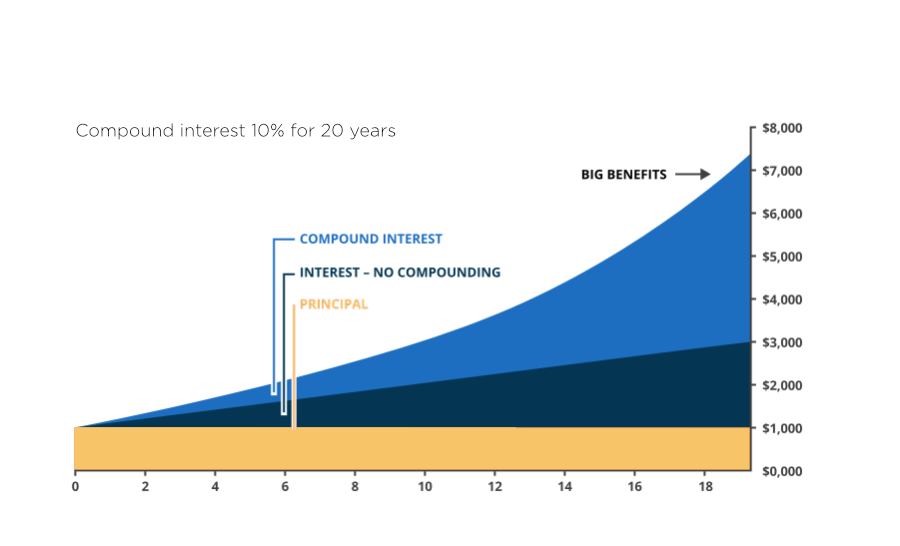

And speaking of investment, start as young as possible, if you can, to take advantage of the hallelujah for savers that is compound interest - that when you save money, as well as earning interest on your savings, you also earn interest on the interest itself.

The sooner you start saving, and the sooner you put compounding to work for you, the better.

Too late for savings advice?

All very good, I hear you say, but. For many of us that horse has bolted long ago. What about those of us no longer young enough to 'start saving early'?

In this case it’s definitely time to take a leaf out of Leonard’s book and get back out there - be a late bloomer and reinvent ourselves for a brilliant third act.

Reinventing yourself for a brilliant third act

One strategy to make your money last longer is to relocate to a state or country state where the cost of living is lower. For example, you could take a leaf out of writer Elizabeth Gilbert’s book, cut off your hair and move to a tropical island.

Or, for us civilians, move to a country where it's cheaper to live and, say, work part-time locally, or remotely on an online business.

Reignite your life with purpose

Alternatively, setting up a social enterprise may be more in your way of thinking, like Glasgow-based cycling enthusiast Bill McGowan. He wanted to use his love of bikes and fitness to encourage people in a fun, interactive way to embrace healthier lifestyles.

So he set up 'Fun and Fit Bike' which provides activities such as the smoothie bike.

There's also no age limit to staying commercially minded and starting your own business, maybe in the field you are already working in. You can keep it small and niche, or you may even be spectacularly successful like Dave Duffield. He co-founded 'Workday' aged 64 and the company is now worth over $43 billion.

Get creative

Or perhaps you’ve always wanted to devote yourself to a creative pursuit.

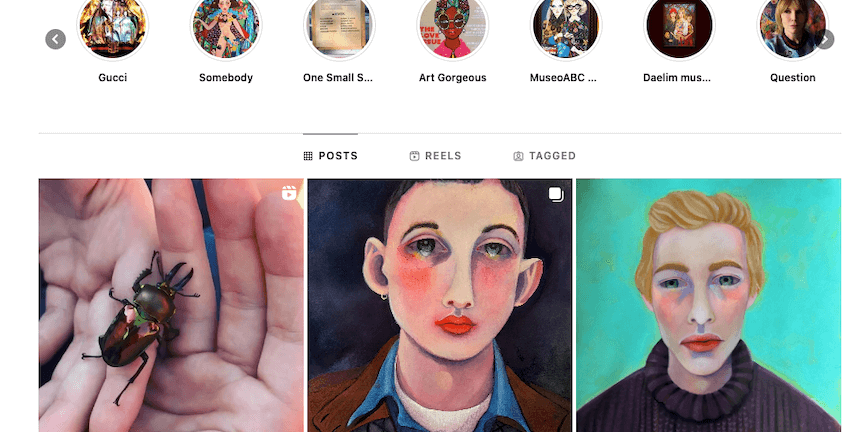

Helen Downie, for example, started painting at the age of 48 and, despite no formal training, within two years gained industry-wide fame and commissions from the likes of Gucci and Vogue through posting her work on Instagram [@unskilledworker].

Mary Wesley published her first novel for adults at the age of 71, taking up writing as a way of restoring her finances after being left impoverished by the death of her second husband, Eric Siepman. Over the next ten years she penned a series of bestsellers, including her most famous book The Camomile Lawn.

Or Dorset-based Richard Gregory who, after a career as a graphic designer took an MA in fine art and is now a practising multidisciplinary artist.

Whatever your situation

The thing is, you may have savings or maybe you don’t. Things may have gone to plan, or they may have gone spectacularly wrong. Whether you’re starting from a blank sheet or know exactly what you want to do in your later years...

While there’s breath in your body, there’s life.

Live it.

Please note: This article is for informational and educational purposes only; it should not be construed as advice. If you would like to get advice on your savings and investments, consider speaking to a financial adviser.

Photos: We have sought to credit photographers and contact rights holders. If any issues, please get in contact and we will remedy promptly. Thank you.